Restore America

(Exercising my 1st Amendment rights to Freedom of Speech)

NATIONAL ECONOMY

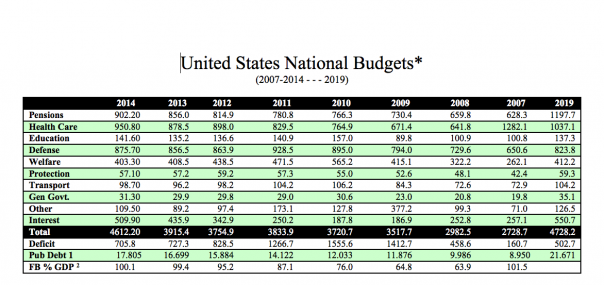

Historically, until 2007 this country has carried, what was considered a manageable annual budget deficit and an associated national debt as compared to the Gross National Product. Since the 2008 inauguration of President Obama and with the support of a Democratic controlled Senate and a lackadaisical Republican House of Representatives, our national debt has grown at an exponential rate and today (Sept 2014) at $ 17.8 trillion it has more than doubled and by 2019 it is projected (conservatively estimated) to reach beyond $ 21 trillion (Ref United States National Budgets pg 12 of this paper).

The major drivers inflating the national budget since 2007 are Health Care which increased by 163 %, the National Debt by 198.9 % and the attendant increase in the national debt have contributed to the 219.7% increase in the interest due on the National Debt .

The current level of national debt $17.8 trillion equates to a personal debt of $55,694 for every man, woman and child in the United States. If amortized at 2.89 % interest for 30 years the monthly costs per citizen would be $232.00 or $ 696 for a family of three. While that may appear to be an achievable goal in actuality, according to some economists, the United States national debt cannot be paid off because that debt continues to grow exponentially, both through interests on the debt ($ 2.17 trillion since 2008) and the continued added debt accrued through the gross budget deficit spending ($ 993.6 billion annual average since 2008).

Also note that the deficit spending annually is greater than the interest due on the national debt thereby basically negating any probability of any decrease or stability in the national debt burden. The monies borrowed to satisfy the budget deficits is also inclusive of the funds needed to pay the interest on that borrowed monies.

Taking this beyond 2014, what appears to be extremely optimistic guesstimated budgets through 2019, estimated interest payments of $1.67 trillion and deficit borrowing of $2.46 trillion, bring the national debt to $21.98 trillion – a 23.5 % increase over the 2014 deficit. In this context then it is obvious that under current government budgetary mandates and priorities that our national debt will continue to increase at an exponential rate reaching (or already has reached) non recoverable catastrophic levels. According to economists, exponentially rising debt is not sustainable because the capacity to service the debt is finite. Without a means of extinguishing debt, servicing is merely borrowing new money to pay off old debts.

As explained by one economist, the government borrows money from its citizens from such accounts as Social Security, uses the money to bridge the gap between budget and available revenues and then taxes the owners of that money (citizens) to pay back the loan taken from them by government – a perfect Catch 22 situation.

In review of the national debt as compared to the Gross National Product, it was evident that the true GNP-ND problem became a significant concern in 2008 coincident with President Obama, as supported by an ultra liberal Democratic Senate and an ineffective Republican House. Basically, the resultant draconian national debt will never be repaid and we can look forward to continued inflation, deprivation of opportunities, loss of national security and a very bleak future for our descendants

National Debt September 23 2014: 17,749,004,354.887.84

Gross Domestic Product 2014: 16,800,000,000,000.00

Gross National Product 2014: 16,128,000,000,000.00

National Budget 2014: 4,612,200,000,000.00

Budget Deficit: 705,800,000,000.00

National Debt September 24 2011: 14,700,040,072,613.72

Gross Domestic Product 2011: 15,783,451,000,000.00

National Budget 2011: 3,833,900,000,000.00

Budget Deficit: 1,266,,700,000,000.00

National Debt September 22 2008: 9,192,242,045,390.41

Gross Domestic Product 2008: 15,006,629,000,000.00

National Budget 2008: 2,982,500,000,000.00

Budget Deficit: 458,600,000,000.00

National Debt September 23 2007: 8,993,695,814,452.51

Gross Domestic Product 2007: 13,857,900,000,000.00

National Budget 2007: 2,728,700,000,000.00

Budget Deficit: 160,700,000,000.00

It is easy to see that Congress must adjust budgets and cut government spending . While Congress and the government administrations since 2007caused the problem, they have no real solution or political motivation to prevent catastrophic failure of our national economic system. And we the tax paying United States citizens will continue to face and suffer the consequences of the multifaceted impacts of our collapsing economic base due to Congressional inaction.

That inaction involves Congressional inertia in respect to recognizing and resolving the obvious individual issues which have caused our economic crises. The liberal elements of Congress and successive administrations appear focus on a parochial political obsession to capture and maintain a voting block to ensure perpetuation of their parochial issues – regardless of the detrimental impacts of those issues on the viability and longevity of our Republic.

Basically, there are solutions to our economic problems wherein major concessions must be made to the existing ethos of our national leaders. On the basis that economic strife is derived from possessing a finite amount of dollars which are insufficient to meet financial obligations. The premise then is to find ways and means to increase the revenues while curtailing obligations and to responsibly provide for the essential needs of the nation and its citizens.

While the value of the stated premise is indisputable; over the past 65 years, and most particularly within the past 7 years, the national trend has been focused on invigorating the economies of the world while compromising the economies of the United States. A major factor influencing the national economy as well as the economy of the American family focuses on the continuing export of American jobs to overseas locations – unemployment and underemployment.

While the Wall Street Journal (4 Oct 2014) heralds the unemployment rate dropping below 6%, steady monthly increases in payrolls, and a 1.2 % increase in the Dow Jones Average, they do so cautiously with some realistic caveats:

“Despite the latest progress, 9.3 million workers are still searching for work, almost a third of them unemployed for six months or more. A broader unemployment measure including part-time workers who can’t find full time jobs and those too discouraged to apply for work stood at 11.8% in September”

Within that sphere of cautionary optimism, the fact remains that American companies and corporations are continuing to ship American jobs overseas. In line with this, Phyllis Schlafly, in her April 30 2007 Townhall.com article, has summarily defined the basic reasons that American companies move overseas, abolishing United State jobs as (quote):

a. They can hire workers at very low wages (such as 30 cents an hour in China).

b. The companies don’t have to pay any employee benefits.

c. They don’t have to comply with safety and environmental regulations.

d. They don’t have to pay foreign taxes when they export their products back to US.

Aside from the extremely low wages paid in China and most overseas third world and developing countries, dealing with moderation of the three specified incentives, in favor of retaining jobs nationally, are within the purview of the United States Congress and the presidential cabinet. However, either through motivational inertia, political submissiveness in dealing with foreign trade partners or parochial partisanship in dealing with national issues, the problem of curtailing exporting American jobs overseas has remained unresolved – thereby enabling the continuing erosion of our national job market and economy.

That motivational inertia, despite predicted gains in economic recovery, has enabled the depressed state of the American worker and work force to continue to deteriorate as more companies move their operations overseas and illegal immigrants (with or without immunity) continue to take American jobs. However, continued deferral of essential national and international dynamics will continue to enable the dismantling of our essential industrial complexes and export of our job market overseas due to:

– existing United States corporate tax rates, at 35 %, are significantly higher than the rates in other developed foreign countries. The lower tax rates increase corporate profits and enable the corporations to become more competitive in the global market. It is evident that existing United States tax codes require significant revision, and while congress is considering a major overhaul of the codes, corporations are cautiously concerned about the resultant outcome of congressional revisions.

Conversely, foreign firms focus on a Value Added Tax (VAT) wherein foreign governments do tax corporations but through the processes of of a rebate on taxes for products exported to the United States or other countries basically eliminate the taxes on the producing corporation/company.- that rebate being the VAT. The VAT works 2 ways, both of which are advantageous to the foreign country of production and disadvantageous to the United States. It’s like paying poker with a stacked deck.

The VAT is essentially a foreign nations means of raising taxes – the consumer in those markets pays for the value added to a product as it processes through assembly. When that product is sold domestically, the foreign consumer pay the VAT on the product thereby “paying their taxes”. When that product is exported the cost of transporting that product to its final destination is added to the VAT. This expanded VAT is then paid by the end user when they purchase the product on their domestic market and the tax of the corporation is basically rebated (forgiven). Essentially then the American Consumer is paying the foreign taxes on American companies and American products produced overseas.

Similarly, when a product is produced within the United States, the cost of that product on the American market includes the cost of production, transportation and marketing PLUS the related local sales taxes. When that product is exported, the host country adds their VAT and associated tariffs to the marketing cost of that product.

These unfair foreign trade practices skew the market against fair competition for American made products, induces American companies to relocate overseas and penalizes the American consumer in terms of excess costs and loss of employment. What is not mentioned is the impact of a deteriorated economy on what has been the negative impact on American consumerism. Shelves and show rooms, devoid of Made in America by American products, are loaded with made in foreign countries products, but the stringent economy of the American family is such that consumer demand has diminished and the American consumer is increasingly demanding return of Made in America By American labels on products sold in the United States.

Ergo, through the lack of dynamics in international dealings to equalize competition, our government in essence rewards foreign governments, American businesses and industries for their concerted efforts to capitalize from the American economy and in turn destroy that very economy which sustains their economic viability.

and

– government mandated and union sponsored exorbitant benefits packages (125-140% of employee salaries/wages) raise the overall burden rate for industries to produce products competitively in the United States. These benefits, compounded by the cost of compliance with government mandated and controlled safety regulations, Environmental Protection mandates and with the inclusion of President Obama’s Affordable Health Care mandates impose excessive burden rates and associated penalties for non compliance on American businesses and industries. The excessive government mandates and controls were and are instrumental in the downsizing of the full time employment population base, establishing part time employment positions (less than 30 hr a week) and providing incentive for American companies to move businesses and industries out of the United States. Included within this category is President Obama’s recent push to increase the minimum wage to $15 an hour – a rate which would cripple small businesses and negatively impact larger corporations economies.

In this respect consider one of the factors which induce American companies to transfer operations overseas is the availability of cheaper labor in foreign employment markets. Then any discussion of increased minimum wage is counter productive as a tool to restore American industry and national economy.

Since American companies relocated to overseas locations are not required to comply with the United States government regulations, mandates and controls those companies have significantly reduced burden rates. Those dollar savings in turn effect the overall costs of production and provide a positive advantage competitively over products made in America by Americans.

The imposed burden rates and associated safety and Environmental regulations compliance unfavorably weaken the competitiveness of American made products both internationally and domestically. Add to this burden rate the advantages offered foreign corporation products through the double edge import and export subsidies of VAT and American made products cannot compete price wise with foreign im ports on the American market. In this respect, the United States governments has been indecisive, ineffective and dynamically inactive in countering the apparent violations of the World Trade Organizations Trade Agreements on Tariffs and Free Trade. Foreign manufacturers armed with VAT as well as the burden rates on benefits and mandated costs associated with safety and Environmental mandates/regulations aids and abets maintaining a more than favorable competitive edge of foreign import over Made in American products globally.

Ergo: The United States government (Congress, the President and the Presidential Cabinet) is equally culpable in the degradation of the United States job market and faltering economy. Procrastination on proposed 2008 congressional bill to Negate VAT apparently sits in the congressional never never land archives. Basically, as stated in Kevin O’Brien’s 27 December 2008 article “The US should demand a new strategy which defies systematic translations of equality and demand a level playing field – or conversely establish its own ‘protectionism’ strategies to counter unfair foreign trade.”

In this respect then effective government is the lynch pin to ensure a level playing field:

“The existence of a free market does not of course eliminate the need for government. On the contrary, government is essential both as a forum for determining the “rule of the game” and as an umpire to interpret and enforce the rules decided on.” — Milton Friedman, Capitalism and Freedom.”

To date our United States government has not exercised the necessary functions as an umpire in assuring quid pro quo actions and reactions to unfair foreign trade.

and

– first and foremost, foreigners crossing our borders without authorization or documentation are committing a criminal act against the United States of America. Data on number of illegal immigrants, and immigrants whose visas have expired, within the United States is non definitive since various and sundry website immigration tracking and reporting agencies data bases do not agree. The estimated illegal immigrant population as reported varies between 11,000,000 and 25,000,000 million. However, Homeland Security, Federation for Immigration Reform (FAIR) and Pew Research Center estimate that 11-12 million illegal immigrants are within the United States. The 11-12 million illegal immigrant count does not take into consideration the recent incursion of 10s of thousands illegal immigrant “youth” who crosses our borders en masse under the “wink wink” good Samaritan sanctions of our federal government.

Despite legislation which prohibits employment of illegal immigrants local, state and federal governments turn a blind eye to enforcement of the immigration law and employment laws. Taking into consideration the employment of illegals as well as a population of documented foreign nationals issued Green Card work permits each foreign national (legal or illegal) employed within the United States deprives American workers of those job opportunities. As stated in the Illegal Immigration package to this paper, 8.9 million illegal immigrants occupy jobs within the united States while another 14,000 jobs in high tech are being filled by immigrants with valid work permits. Consequences: almost 9,000,000, American workers are unemployed or underemployed and receiving government social services benefits due to employing foreign workers in American jobs.

The inclusion of illegals into the United States work force and their eligibility for social services, welfare, education and medical benefits impact the economic well being of the American worker as well as the already over-stressed assistance programs . These agencies require significantly increased budget allocations to provide the services and subsidies for the significantly increased base of qualified recipients which includes the newly unemployed, underemployed and welcomed illegal immigrants.

While it is arguable that the immigrant employment adds to the Gross Domestic Product in respect to their earned income, there is also the downside. During 2013, alone over $ 120 billion was sent back to immigrant workers native lands thereby contributing to the reduction of the GDP to the much lower Gross National Product upon which government establishes its budgets and deficit spending levels. Latin American and Mexican workers within the United State contributed to the dollar drain by sending $31.8 billion to Latin American counties and $22 billion to Mexico (44% of the total). Coincidentally, another $ 13.45 billion (11 %) was sent to China and $10.84 billion (9 %) to India – both nations further capitalizing from the American economy by the continuing relocation of American jobs to their countries.

On this basis then, the American economy faces a triad of debilitating challenges from immigrant labor:

– Increased national costs (budgets) to provide social services, welfare and medical benefits for unemployment and underemployment of American workers and their families;

– increased national costs (budgets) to include social services, welfare, medical and educational subsidies for illegal (employed at minimum/low wages or unemployed) and documented workers and their families;

– Immigrant workers dollar flow out of country which otherwise could/would contribute to easing the faltering commerce within the United States.

Again, within this context, the United States congress, president and presidential cabinet have turned a blind eye to this major contributor to the nation’s economic problems. Knowing the consequences of the illegals in terms of depressed national economy, employment, national health issues, and security, when asked to act on the recent surge of illegal infiltrators to the United States our national leaders procrastinated, enjoyed golfing excursions, relaxed on congressional recess and ignored the problem. While other nations would forcibly deter illegal immigration into their sovereign territories, our government officials constrain the authority and ability of our National Guard, Local level police agencies and the Homeland Security Border Patrol Agencies from carrying out their assigned and designated responsibilities.

Aside from the economic impacts of illegal immigration, a major concern focuses on the “open door” illegal pathway into the United States which facilitates the unhampered flow of drugs, illegal and illicit entrepreneurs and most grievously – terrorists whose sole aim is to destroy the United States of America.

Essentially then, in terms of serving the American citizens, The President, Congress and presidential cabinet only dynamic actions have been to ask the American public to pick up the tab for their inept management of our national economy. Similarly, our national leaders in their problem solving inertia ignore the consequences of a drug infested nation as well as concentrated cells of Al Qaeda and ISIS terrorists. Then the question remains, who and what are our national leaders supporting and why have they acted contrary to the good will and benefit of America.

Notes: * Extracted from usgovernmentspending.com 1. Trillion Dollar base – 2014 Debt set as of Sept 22 2014 2. Federal Budget percentage of Gross Domestic Product National Debt leaders (Percent Increase since 2007):

Pensions 143.6%

Health Care 161.3%

Defense 134.2%

Welfare 125.1% I

Interest 219.7%

(Debt 198.9%)